Moving Averages are one of the most popular and easy to use indicators available in Forex. They smooth a data series and make it easier to spot trends, something that is especially helpful in volatile markets. They also form the building blocks for many other technical indicators and overlays.

The two most popular types of moving averages are as below;

SMA (Simple Moving Average)

EMA (Exponential Moving Average)

A Simple Moving Average (SMA) is formed by computing the average (mean) price of the security over a specified number of periods. While it is possible to create moving averages from the Open, the High and the Low data points, most moving averages are created using the closing price. For example: a 20-day simple moving average is calculated by adding the closing prices for the last 20 days and dividing the total by 20.

In order to reduce the lag in simple Moving Averages (SMAs), technicians often use Exponential Moving Averages (EMAs). EMAs reduce the lag by applying more weight to recent prices relative to older prices. The shorter the EMAs period is the more weight will be applied to the most recent price.

The simple moving average obviously has a lag, but the exponential moving average may be prone to quicker breaks. Some traders prefer to use exponential moving averages for shorter time periods to capture changes quicker. Some investors prefer simple moving averages over long time periods to indentify long-term trend changes.

Shorter moving averages will be more sensitive and generate more signals. The EMA, which is generally more sensitive than the SMA, will also be likely to generate more signals. However, there will also be an increase in the number of false we signal. Longer moving averages will mover slower and generate fewer signals. These signals will likely prove more reliable, but hey also may come late.

Each investor or trader should experiment with different moving average lengths and types to examine the trade-off between sensitivity and signal reliability, because moving average follow the trend, they work better when a currency pairs is trending and are ineffective when a currency pair more in a trading range.

A-Trend Identification and Confirmation

If the price is above a moving average and this moving average is moving up, we're in an uptrend but if the moving average is moving down and the price is below the moving average, we're in a downtrend.

You can also use 2 different Moving Averages to spot the trend. For example, if you use a 10 and a 20 moving averages. If the SMA10 is above the SMA20, you're in an uptrend. If the SMA10 is below the SMA20 you're on a downtrend.

[b]B-Support and Resistance Levels

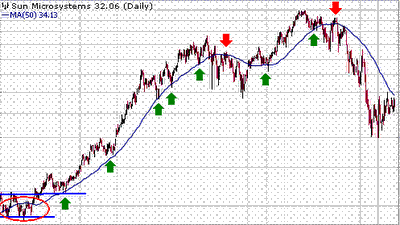

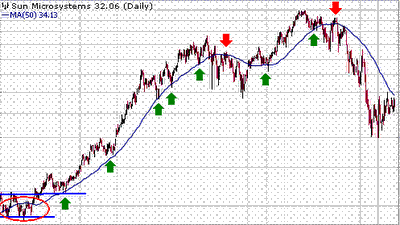

Another use of moving averages is to indentify support and resistance levels. This is usually accomplished with one moving average and is based on historical precedent. As with trend identification, support and resistance level identification through moving averages works best in trending markets.

This strong support area can be used as an entry point. There are even some more trading systems build solely on moving averages. On this kind of systems, when the price crosses the moving average to the upside is a buy and when it crosses below the moving average is a sell. On Strong trends, this kind of trading systems work well. However, during choppy markets, there are plenty of false signals for this kind of systems.

The two most popular types of moving averages are as below;

SMA (Simple Moving Average)

EMA (Exponential Moving Average)

A Simple Moving Average (SMA) is formed by computing the average (mean) price of the security over a specified number of periods. While it is possible to create moving averages from the Open, the High and the Low data points, most moving averages are created using the closing price. For example: a 20-day simple moving average is calculated by adding the closing prices for the last 20 days and dividing the total by 20.

In order to reduce the lag in simple Moving Averages (SMAs), technicians often use Exponential Moving Averages (EMAs). EMAs reduce the lag by applying more weight to recent prices relative to older prices. The shorter the EMAs period is the more weight will be applied to the most recent price.

The simple moving average obviously has a lag, but the exponential moving average may be prone to quicker breaks. Some traders prefer to use exponential moving averages for shorter time periods to capture changes quicker. Some investors prefer simple moving averages over long time periods to indentify long-term trend changes.

Shorter moving averages will be more sensitive and generate more signals. The EMA, which is generally more sensitive than the SMA, will also be likely to generate more signals. However, there will also be an increase in the number of false we signal. Longer moving averages will mover slower and generate fewer signals. These signals will likely prove more reliable, but hey also may come late.

Each investor or trader should experiment with different moving average lengths and types to examine the trade-off between sensitivity and signal reliability, because moving average follow the trend, they work better when a currency pairs is trending and are ineffective when a currency pair more in a trading range.

A-Trend Identification and Confirmation

If the price is above a moving average and this moving average is moving up, we're in an uptrend but if the moving average is moving down and the price is below the moving average, we're in a downtrend.

You can also use 2 different Moving Averages to spot the trend. For example, if you use a 10 and a 20 moving averages. If the SMA10 is above the SMA20, you're in an uptrend. If the SMA10 is below the SMA20 you're on a downtrend.

[b]B-Support and Resistance Levels

Another use of moving averages is to indentify support and resistance levels. This is usually accomplished with one moving average and is based on historical precedent. As with trend identification, support and resistance level identification through moving averages works best in trending markets.

This strong support area can be used as an entry point. There are even some more trading systems build solely on moving averages. On this kind of systems, when the price crosses the moving average to the upside is a buy and when it crosses below the moving average is a sell. On Strong trends, this kind of trading systems work well. However, during choppy markets, there are plenty of false signals for this kind of systems.

No Comment.